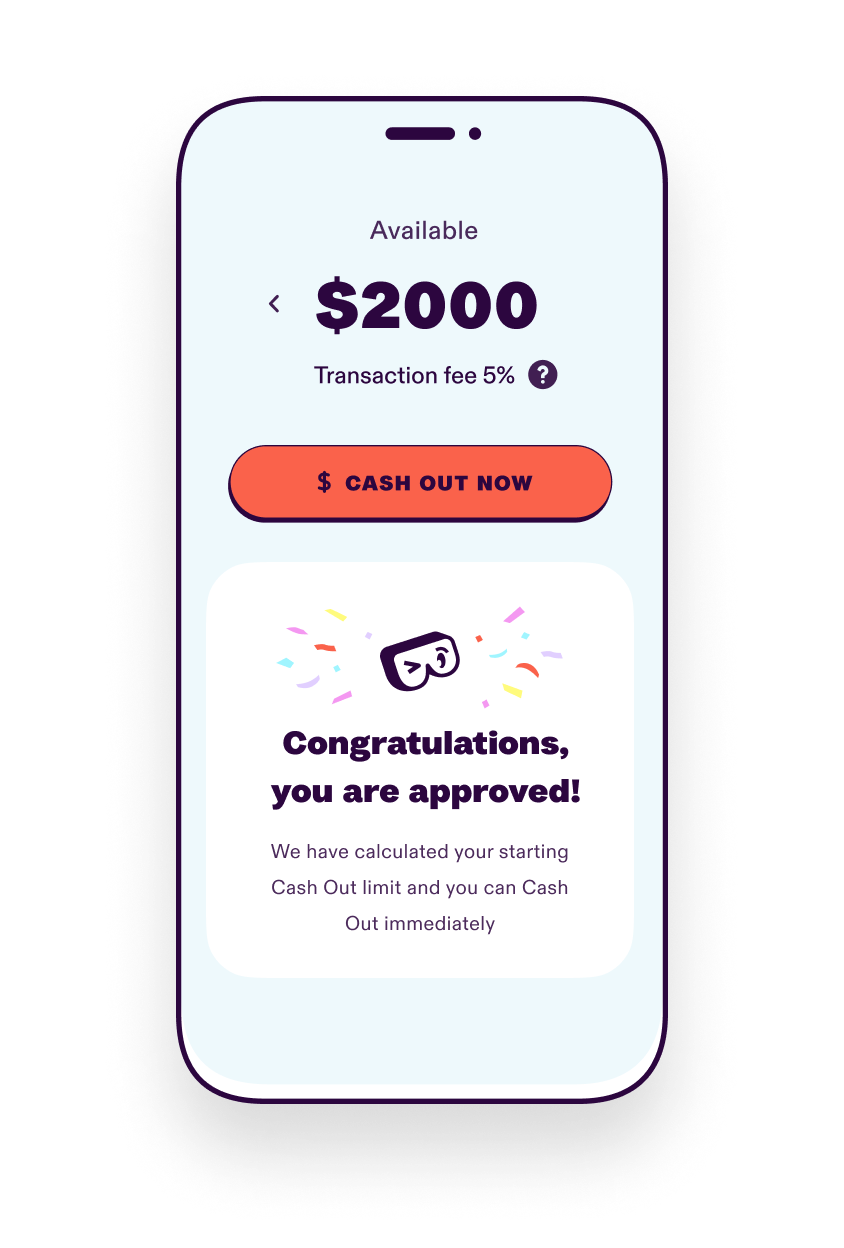

Get payday in advance - up to $2000

Sometimes life throws a curveball, and you need a bit of extra cash to keep your balance before payday—we get it. Beforepay Pay Advance lets you keep up to $2000 in your back pocket, making sure you’re always on the front foot. Because we know life happens, and your funds need to flex with you!

See common use cases for Beforepay Pay Advance.

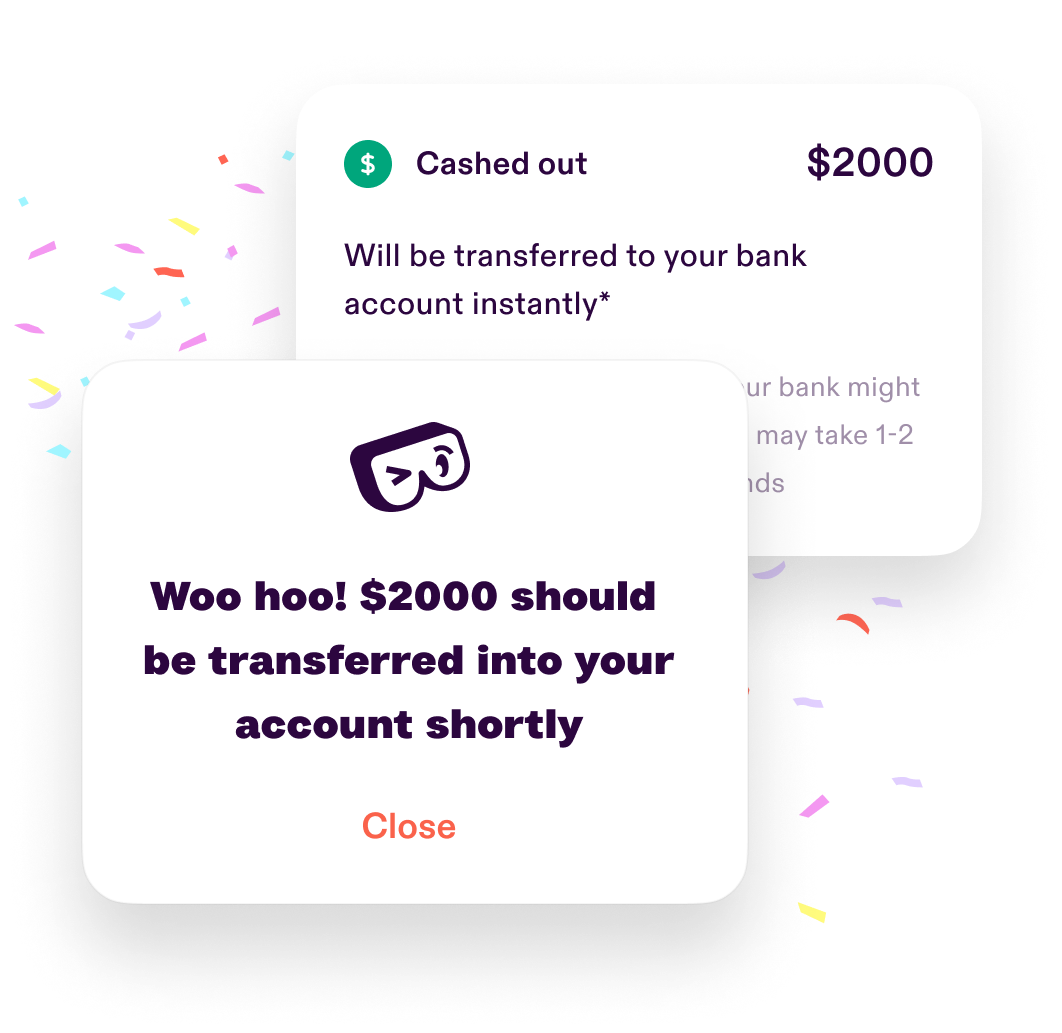

Advance extra funds in as little as 5 minutes

You could make a cuppa, start signing up online, and have cash in your bank before your tea goes cold! There’s not a paper form in sight, and no humans slowing things down when you borrow with Beforepay Pay Advance. Did we mention you can get cash out 24/7? Welcome to the future.

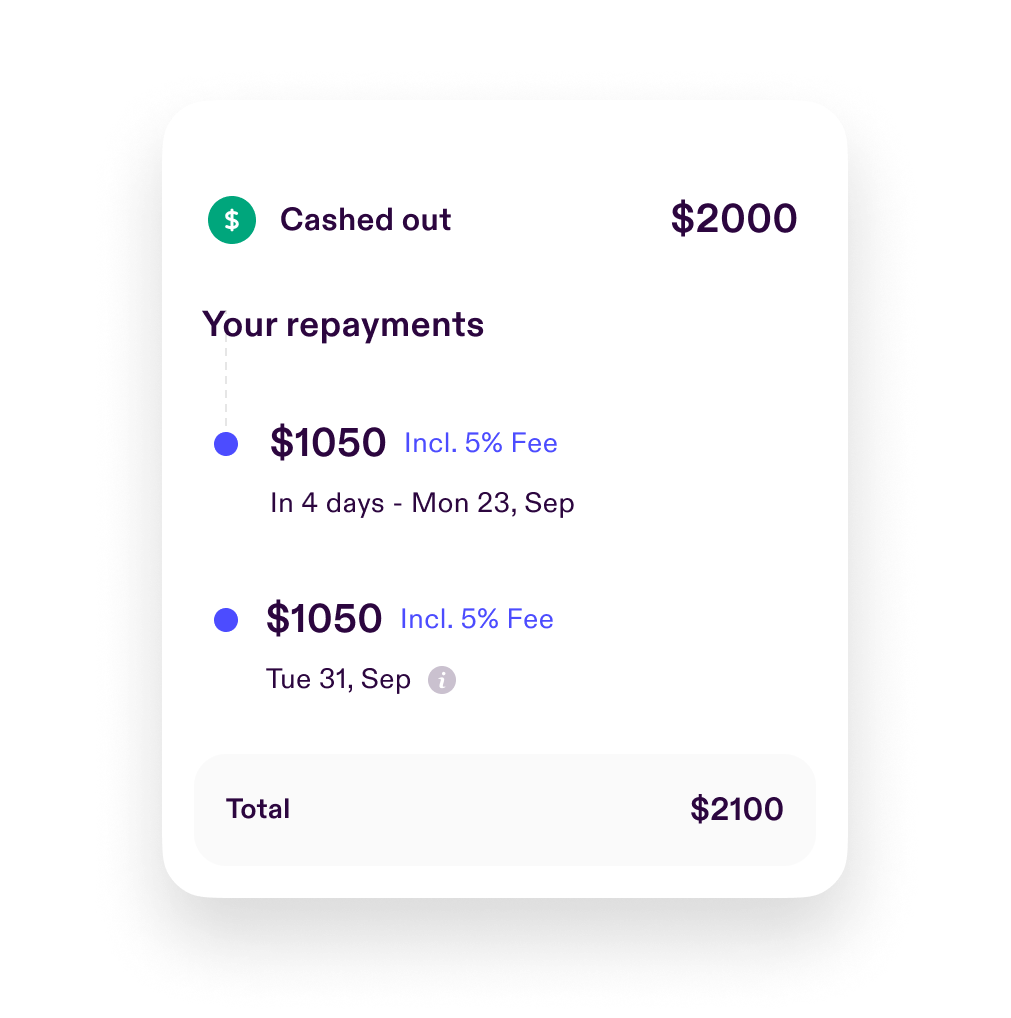

Pay only a 5% fixed fee on your advance

We only charge a fixed 5% fee each time you borrow with Beforepay Pay Advance. That's 5% of what you borrow. So if you take out $100 your transaction fee will be $5 and your total repayment will only ever be $105—never a cent more! There is no interest (APR = 0%) or other fees.

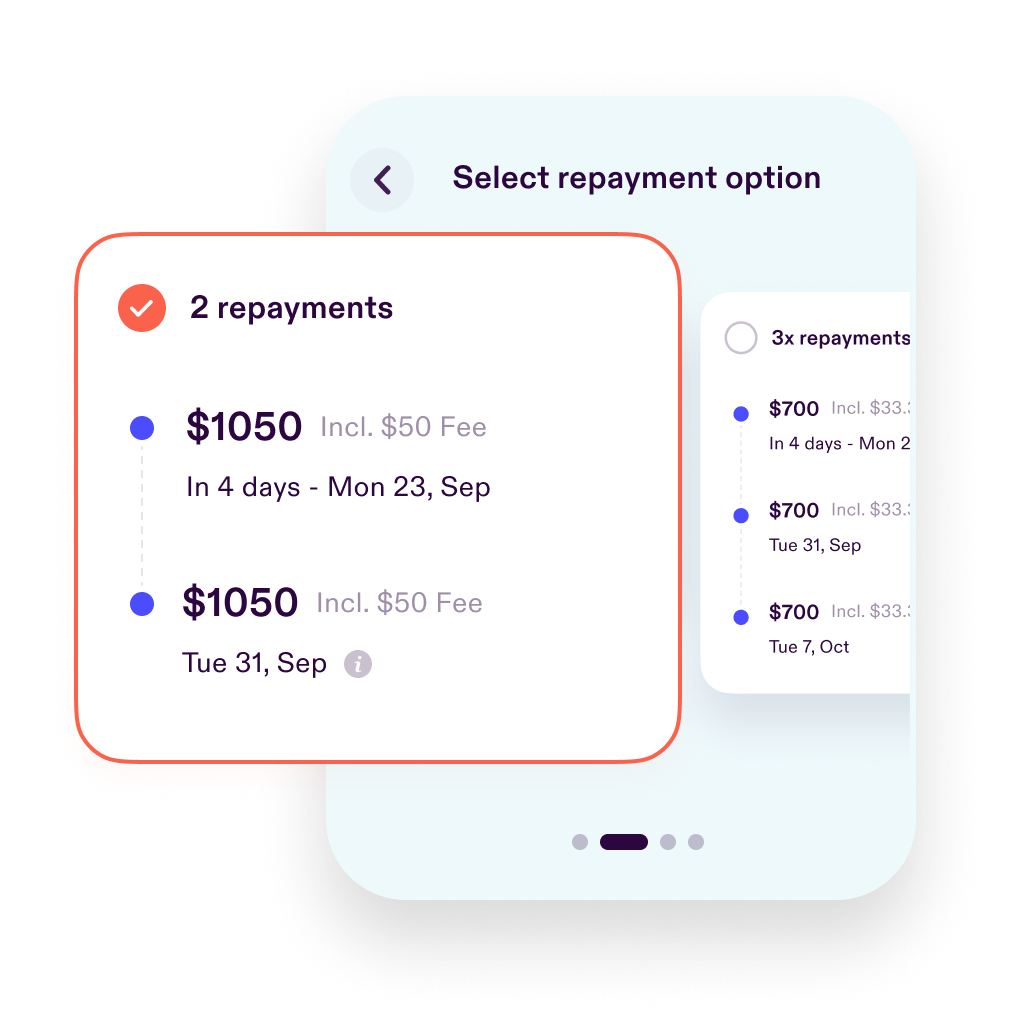

Repay your advance in up to 4 instalments

We’ve got the smarts to align repayments with your pay cycle so that you can repay your Pay Advance when you get paid—simple, and worry-free. You can spread out your repayment across up to 4 instalments, as long as the full repayment is made within 62 days from your cash out date.

Am I eligible for a Pay Advance with Beforepay?

To cash out a Pay Advance with Beforepay you’ll need to meet the below eligibility requirements. You will also need to successfully verify your ID and meet the requirements of our credit risk assessment. Learn more here.

-

Be 18 years or older and an Australian resident.

-

Have a current driver's licence (Australian only), passport or Medicare card (or otherwise pass the identification criteria set out by Beforepay).

-

Be employed and earn at least $300 income per week. Employment may include self-employment, provided that you are an individual and all other eligibility criteria is met.

-

Have 50 per cent or more of your income paid by an employer.